Market Observations

Economy

- The Detroit Metro’s labor market remains stagnant. May’s 3.9% unemployment rate

was up 10 basis points from April levels. - Construction continues to lead employment growth fueled by infrastructure funds to

rebuild major expressways. Meanwhile, the key manufacturing sector showed

employment is 0.6% below May 2023 levels. - The trade and transportation sector showed gradual improvement in employment, up

1.2% from last year.

Leasing Market Fundamentals

- The Detroit Metro industrial market report vacancy rate remained at 3.9% during the second quarter

of 2024. Nearly 70% of 963,866 SF in net absorption during the quarter was attributed

to completed build-to-suit construction. - The construction pipeline has trended mostly downward over the past four quarters.

Build-to-suits make up 1.0 million SF of active construction. Speculative construction

has dropped to 857,000 SF from a high of over 5 million SF last year. - Average asking rent grew by just 0.64% during the second quarter of 2024. The year-

over-year growth rate is far off the 21.54% seen in 2022.

Major Transactions

- Detroit Axle, an automotive parts manufacturer and distributor, leased 156,800 SF at

12001-12005 Toepfer Rd. in Warren. - Convergix, which provides automation and connectivity systems to the automotive

industry, leased 150,102 SF at 800 Standard Pky. in Auburn Hills. - OPW Fueling Components Inc. signed a 130,700-SF lease at recently constructed Allied Commerce Center Building 5 in Livonia.

Outlook

- No new speculative bulk warehouse development have broken ground in 2024 as currently supply is outpacing demand. This will allow the market to absorb existing new inventory levels.

- While the Big Three have scaled back investments in EV, new developments are underway to boost the automotive segment. Ford began construction on 1.8-million-SF EV battery plant in Marshall, MI. Magna International Inc is near completion on a 285,000-SF EV seating plant in Auburn Hills. GM continues to gear up its Orion Assembly for EV production.

- Average asking rent will grow moderately in the coming quarters.

1. Economy

2. Leasing Market Fundamentals

Economy

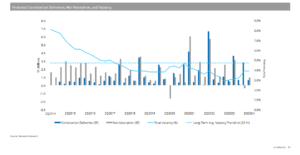

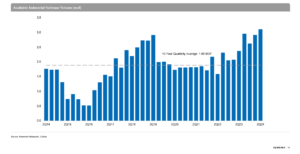

Metro Employment Trends Signal A Slowing Economy

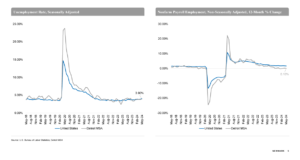

The Detroit Metro’s labor market remains stagnant. May’s 3.9% unemployment rate was up 10 basis points from April levels. Compared to last year, employment levels remained relatively unchanged. Year-over-year employment grew just 0.10%. The unemployment rate remains lower than the 5.7% 10-year historical average.

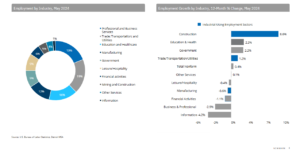

Construction Sector Leads YOY Job Growth While Manufacturing Sheds Jobs

Construction cont inues to l ead employment growth fueled by infrastructure funds to rebuild major expressways. Meanwhile, the key manufacturing sector showed employment is 0.6% below May 2023 levels. Trade, transportation and utilities employment levels grow year over year by 1.2%.

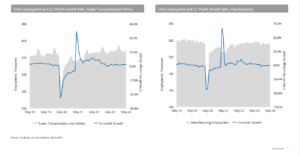

Past Three Months Show Modest Gains in Industrial Employment

In May 2024, year-over-year manufacturing employment was down, however, over the past three months, employment is gradually on the rebound. The trade and transportation sector is also showing gradual improvement in employment.

Leasing Market Fundamentals

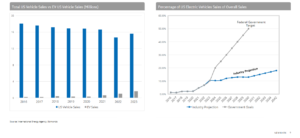

Automakers Put Breaks on EV Investments as Demand Not Growing Fast Enough

GM, Ford and Stellantis have retrofitted assembly plants and invested in battery production and logistical hubs for components. EV production requires significant investments by the Big Three, with a growing but limited customer base. EV growth is critical to scaling production and foster additional investment. US EV sales have mostly trended upward since 2016, seeing the great year-over-year increase of 50% in 2023 for a total of 1.6 million units sold. The federal government has set a goal to make half of all new vehicles sold in the U.S. zero-emissions vehicles by 2030. The Big Three say current demand isn’t growing fast enough to merit much of the planned capital investments. Automotive analysts predict EV sales will make up nearly 20% of overall vehicle sales over the next 20 years. Recently, the Big Three have scaled back investments in EV around the Detroit Metro. Notably, Ford scaled back plans for a $3.5-billion Michigan battery plant, cutting production capacity by roughly 43% to 20 gigawatt hours per year. GM delayed plans to build a $200-million electric vehicle supply plant at the former site of the Palace of Auburn Hills. GM also delayed Orion Assembly plant transition for EV truck production until 2025.

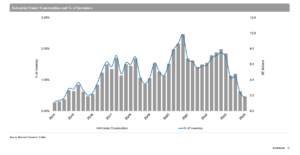

Industrial Market Report Returns to Positive Territory

The Detroit Metro industrial market report vacancy rate remained at 3.9% during the second quarter of 2024. Nearly 70% of 963,866 SF in net absorption during the quarter was attributed to completed build-to-suit construction. The construction pipeline continued to fall with no new starts during the second quarter of 2024. Currently, 1.8 million SF is under construction compared with a high of 7.9 million SF one year ago.

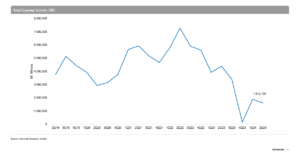

Industrial Leasing Activity Declines as Bulk Warehouse Leasing Slows

Leasing activity has fallen off considerably over the past two years, falling from a high over 7 million during the third quarter of 2022 to 1.6 million during the second quarter of 2024. The drop is attributed to pull back in investments from automakers and a decline in the number of large-block bulk warehouse leases.

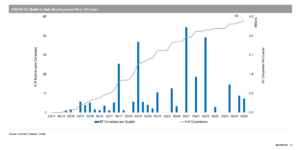

Build-to-Suit Construction Leveling Off

FANUC America Corporation completed construction on a 655,000-SF facility at 2630 Featherstone Rd. in Auburn Hills. Three other BTS developments are nearing completion. Magna International Inc is near completion on a 285,000-SF plant at 1700 Brown Rd., Auburn Hills to supply seats for future General Motors Co. electric vehicles. Target Corp and Gestamp North America are targeting the end of 2024 for completion of 180,000-SF and 460,000-SF facilities in Detroit and Chesterfield Township.

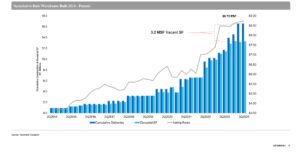

Speculative Class A Warehouse

Over the past 10 years, new speculative bulk warehouse developments saw unpresented growth. Developers built 45 distribution facilities totaling over 16.5 million SF. In each quarter, new deliveries were nearly all absorbed upon completion. Over the same period, asking rates nearly doubled, going from $4.24/SF to $8.72/SF. Recently, the gap between new supply and occupancy has widened to 3.2 million SF.

Industrial Sublease Availability Hits Four-Year High

Sublease volume continued to trend upward during the second quarter of 2024. The rate at which subleases were added to the market has accelerated over the past five quarters. Rising interest rates, an inflationary environment, declining consumer demand and a pullback in the EV market are driving some firms to control costs via supply chain optimization and consolidation, which includes putting excess or underutilized space up for sublease.

Industrial Supply Pipeline Eases as New Inventory Exceeds Current Demand

The construction pipeline has trended mostly downward over the past four quarters. Build-to-suits make up 1.0 million SF of active construction. Speculative construction has dropped to 857,000 SF from a high of over 5 million SF last year. Over the past two years, over 10 million SF of speculative construction have been complete. The gap between supply and demand is growing as new inventory is beginning to exceed user demand.

Asking Rent Growth Continues to Moderate

Average asking rent grew by just 0.64% during the second quarter of 2024. Year-over-year growth rate is far off the 21.54% seen in 2022. Rent growth is expected to moderate throughout the remainder of 2024 as more available space comes on the market.

Notable 2Q24 Lease Transactions

Detroit Industrial Submarket Map

2Q 2024 Overall Metro Detroit Industrial Market Stats